Invoice Based Financing

Simple financing linked to Receivables cycles

How Does Your Business Benefit

from Invoice Financing?

Improve your business’ liquidity with accelerated cash conversion.

Focus on operating and growing your business.

Navigate cash flow seasonality with predictable sources streams of cash

Maintain a healthier balance sheet by avoiding unnecessary debt.

Who is Eligible?

Based in the the UAE and in South Africa

All sectors and sizes are welcomed

Businesses with at least 6 months of operations

Businesses with stable and predictable revenue cycles

How it works

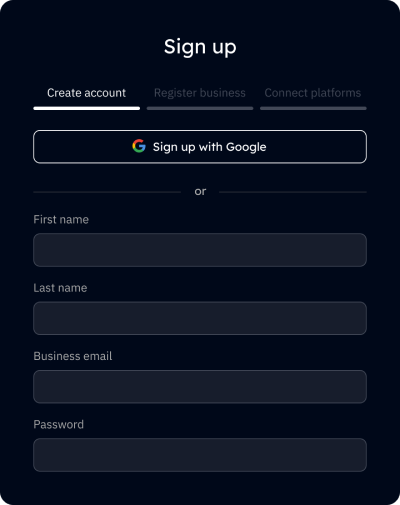

1

Create an account

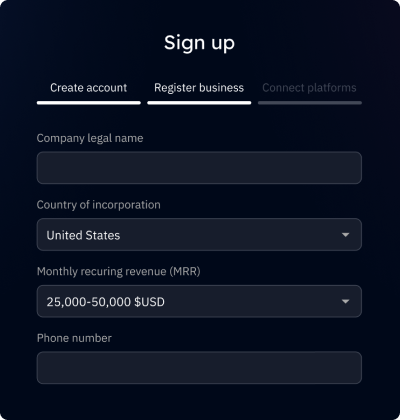

2

Register business

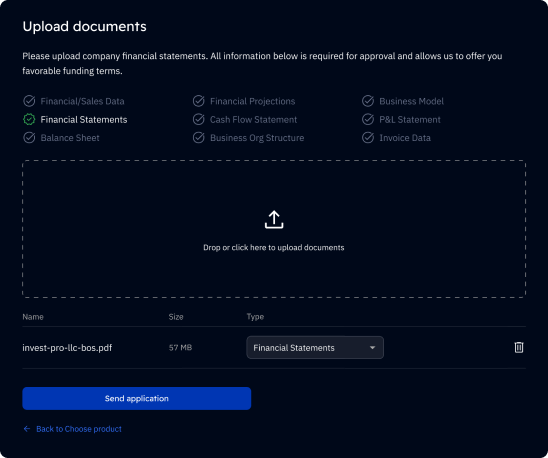

3

Upload documents

4

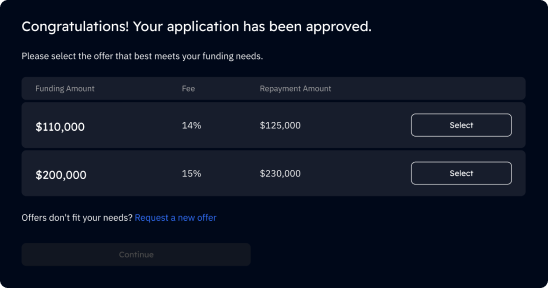

Select offer

5

Receive money

Frequently Asked Questions

What is Flow48?

We are a platform that allows companies to access the capital they deserve by providing Revenue-Based Finance services, fueling SME growth.

How is Flow48 better than a bank?

Our underwriting is flexible and fast, it takes us 48 hours from onboarding to disbursement, and you can always revolve your RBF line. We are long term partners.

How much can I apply for?

Our lending limits are set by our proprietary underwriting engine that outputs a risk adjusted proposal based on multiple factors, particularly your revenues. In other words, we have internal lower/upper limits of how much of your yearly revenues we can advance, and your number will be risk adjusted depending on our evaluation.

When do repayments begin?

We can provide up to $20 million in funding. Each company is analysed on a case by case basis so once you sign up and connect your platforms, we will create the best tailored offers for you.

Does my business qualify?

At Flow48 we aim at being a reliable source of capital to meet our clients needs. Unlike many Alternative Lenders, we are actually sector and size agnostic, our mission is to build a financing layer for most if not all SMEs.